mississippi state income tax brackets

The tax brackets are the same for all filing statuses. Mississippi State Personal Income Tax Rates and Thresholds in 2022.

Excel Formula Income Tax Bracket Calculation Exceljet

Discover Helpful Information and Resources on Taxes From AARP.

. Ad Compare Your 2022 Tax Bracket vs. 4 rows Mississippi state income tax rate table for the 2020 - 2021 filing season has four income. Because of tax cuts approved years ago the tax-free amount will increase to 13300 after this year.

There is no tax schedule for Mississippi income taxes. Tax Bracket Tax Rate. The Mississippi Department of Revenue is responsible for publishing.

Mississippis maximum marginal corporate income tax rate is the 3rd lowest in the United States ranking directly below North Dakotas 5200. 3 rows Mississippis income tax brackets were last changed four years prior to 2020 for tax year. Mississippi collects a state corporate income tax at a maximum marginal tax rate of 5000 spread across three tax brackets.

In addition check out your. Mississippi Income Taxes. Because the income threshold for the top bracket is quite low 10000 most taxpayers will pay the top rate for the majority of their income.

Single married filing separate. The state has been slowly eliminating its lowest tax bracket by exempting 1000 increments every year since 2018. The income tax in the Magnolia State is based on four tax brackets with rates of 0 3 4 and 5.

The Mississippi State Tax Tables for 2021 displayed on this page are provided in support of the 2021 US Tax Calculator and the dedicated 2021 Mississippi State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state. The graduated income tax rate is. The state has a 4 tax on the next 5000 of income and a 5 tax on all income above that.

4 rows The Mississippi income tax has three tax brackets with a maximum marginal income tax. Single tax brackets generally result in higher taxes when compared with taxpayers with the same income filing as Married Filing Jointly or Head of Household. 0 on the first 2000 of taxable income.

Income tax is a tax that is imposed on people and businesses based on the income or profits that they earned. If you are receiving a refund. Mississippi has a graduated income tax rate and is computed as follows.

Back to Mississippi Income Tax Brackets Page. Married filers do not pay taxes on first 36600 of income. Mississippi based on relative income and earnings.

Single income taxpayers do not pay taxes on first 18300 of income. 4 on the next 5000 of taxable income. Taxpayer Access Point TAP.

Eliminates the 4 tax bracket by 2023. Mississippi state income taxes are listed below. This is because the Single filing type does not enjoy the tax benefits associated with joint filing or having dependants.

5 bracket cut to 47 by 2024 44 by 2025 and 40 by 2026. Give Mississippi when fully implemented the fifth-lowest marginal tax rate for states that have income tax although other states are also. Your 2021 Tax Bracket to See Whats Been Adjusted.

Mississippis income tax currently has three marginal rates of 3 percent 4 percent and 5 percent. As of January 1 2022 Mississippi has completed the phaseout of its 3 percent individual income tax brackets. 5 on all taxable income over 10000.

Mississippi has three marginal tax brackets ranging from 3 the lowest Mississippi tax bracket to 5 the highest Mississippi tax bracket. Provides tax relief of 525 million per year by 2026. The corporate rates and brackets match the individual rates and brackets and the brackets.

Eliminate the states 4 tax bracket on peoples first 5000 of taxable income starting 2023. Mississippi Governor Tate Reeves R in his budget proposal for fiscal year FY 2022 has announced his goal of phasing out the states income tax by 2030. The 5 tax on remaining income will drop to 47 for 2023 then 44 for 2025 and 4 starting in 2026.

Mississippi personal income tax rates. Highlights of the income tax cut compromise plan. The tax rates are broken down into groups called tax bracketsIncome tax brackets are required state taxes in.

All other income tax returns. As you can see your income in Mississippi is taxed at different rates within the given tax brackets. The income tax in the Magnolia State is based on four tax brackets with rates of 0 3 4 and 5.

Individual Income Tax. 3 on the next 3000 of taxable income. Any income over 10000 would be taxes at the highest rate of 5.

List Of States By Income Tax Rate See All 50 Of Them With Interactive Map

States With Highest And Lowest Sales Tax Rates

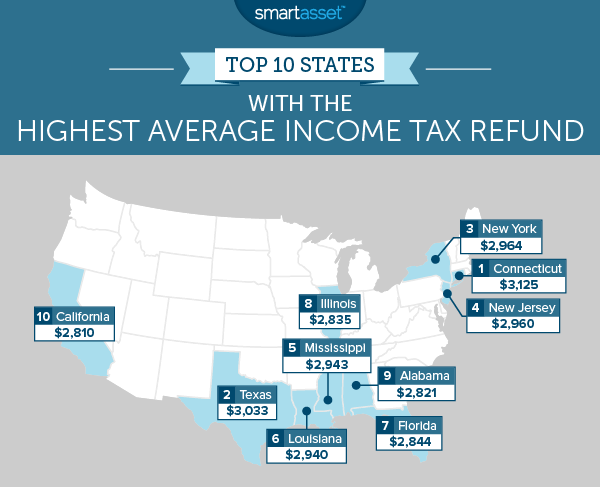

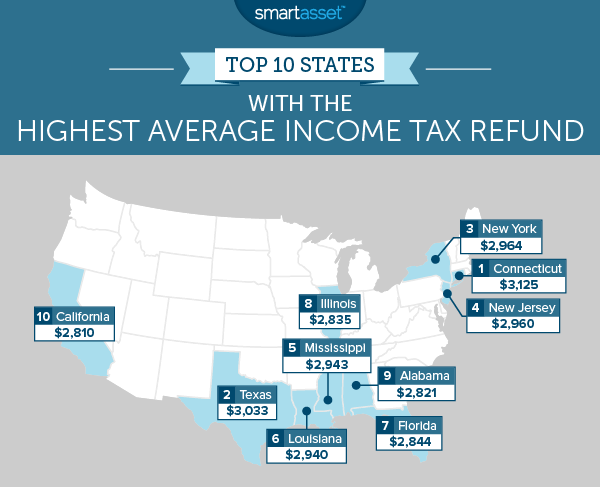

The Average Tax Refund In Every State Smartasset

Where S My State Refund Track Your Refund In Every State Taxact Blog

Tax Friendly States For Retirees Best Places To Pay The Least

Qod How Many States Do Not Have State Income Taxes Blog

State Income Tax Rates Highest Lowest 2021 Changes

Tax Rates Exemptions Deductions Dor

Mississippi Tax Rate H R Block

Tax Rates Exemptions Deductions Dor

Mississippi Tax Rate H R Block

How Do State And Local Individual Income Taxes Work Tax Policy Center

National And State By State Estimates Of President Biden S Campaign Proposals For Revenue Itep

Mississippi Income Tax Calculator Smartasset

How Do State And Local Individual Income Taxes Work Tax Policy Center

State Corporate Income Tax Rates And Brackets Tax Foundation

Mississippi Tax Forms And Instructions For 2021 Form 80 105

State Corporate Income Tax Rates And Brackets Tax Foundation

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)